A dramatic U.S. Open at Pinehurst and Father’s Day are freshly behind us. For those in the golf retail business, last week was their Super Bowl.

While we can’t report on last week’s sales results as quickly as the viewership ratings (up big!), this is a good time to write about how golf equipment sales, retail and the broader appetite for golf goods is trending across the industry.

While every category is different, NGF research points to continued positive momentum and general stability on the buying front.

Approximately 80% of golfers indicate they purchased some golf-related merchandise in the past 12 months. And nearly half of golfers suggest they expect to buy a golf club (or clubs) within the next year.

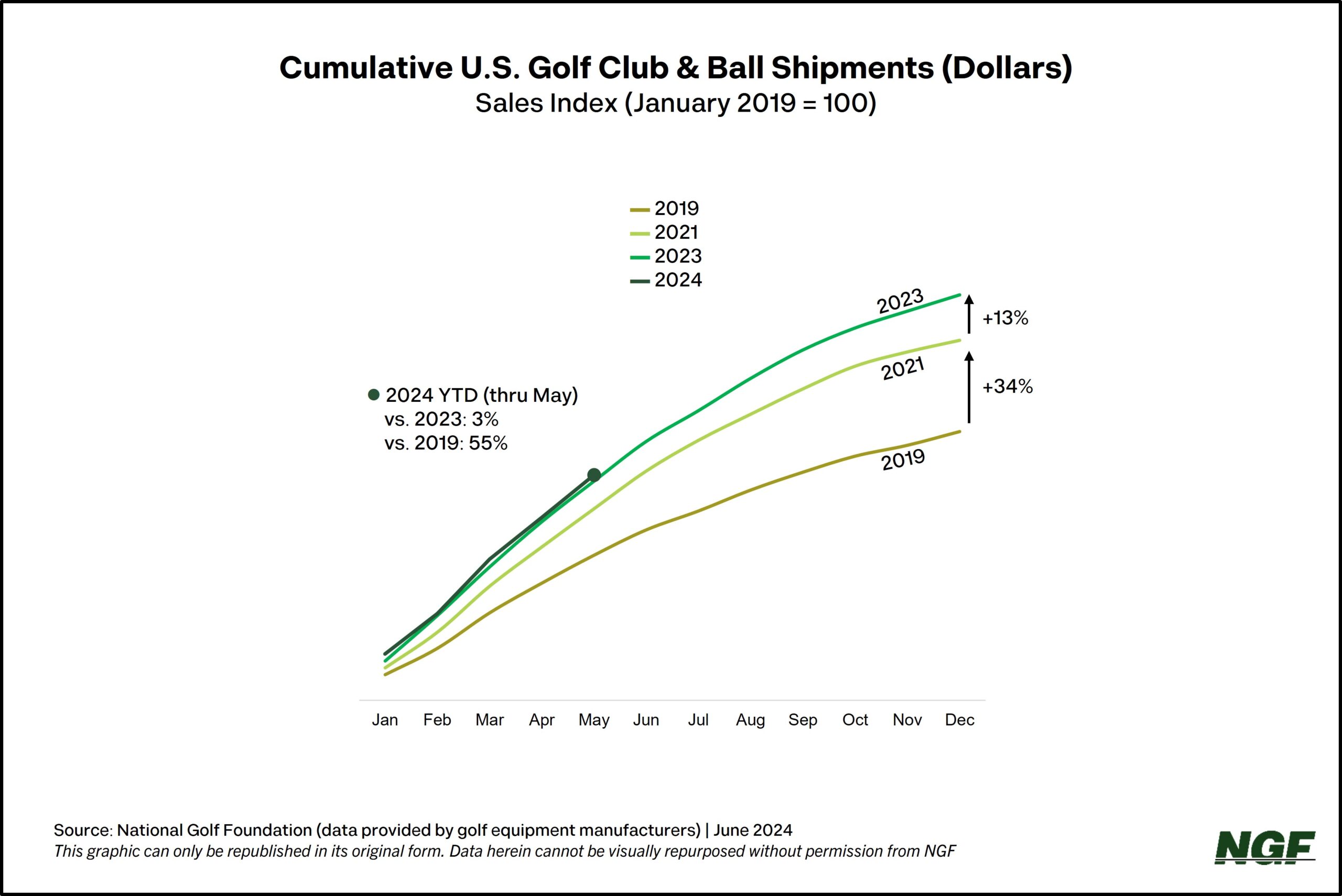

Our aggregated Industry Sales Reports# show that cumulative golf club and ball shipments are up slightly (3%) versus a year ago and running 55% ahead of our pre-pandemic base index. Golf ball sales have been the primary driver on the equipment side at +7% year-over-year entering June, with clubs relatively flat (+1% YOY). This tracks with the year-to-date national gains in play, as golf balls are the game’s ultimate consumable.

Compared to recent years, there are some signs of softness on the hard goods front when it comes to sales of metalwoods or full iron sets, but retailers we’ve talked to point to:

- continued trending ahead of pre-pandemic years

- replacement cycles and the notion that some consumers may be holding off for now after purchasing new equipment during or on the heels of pandemic-related lockdowns

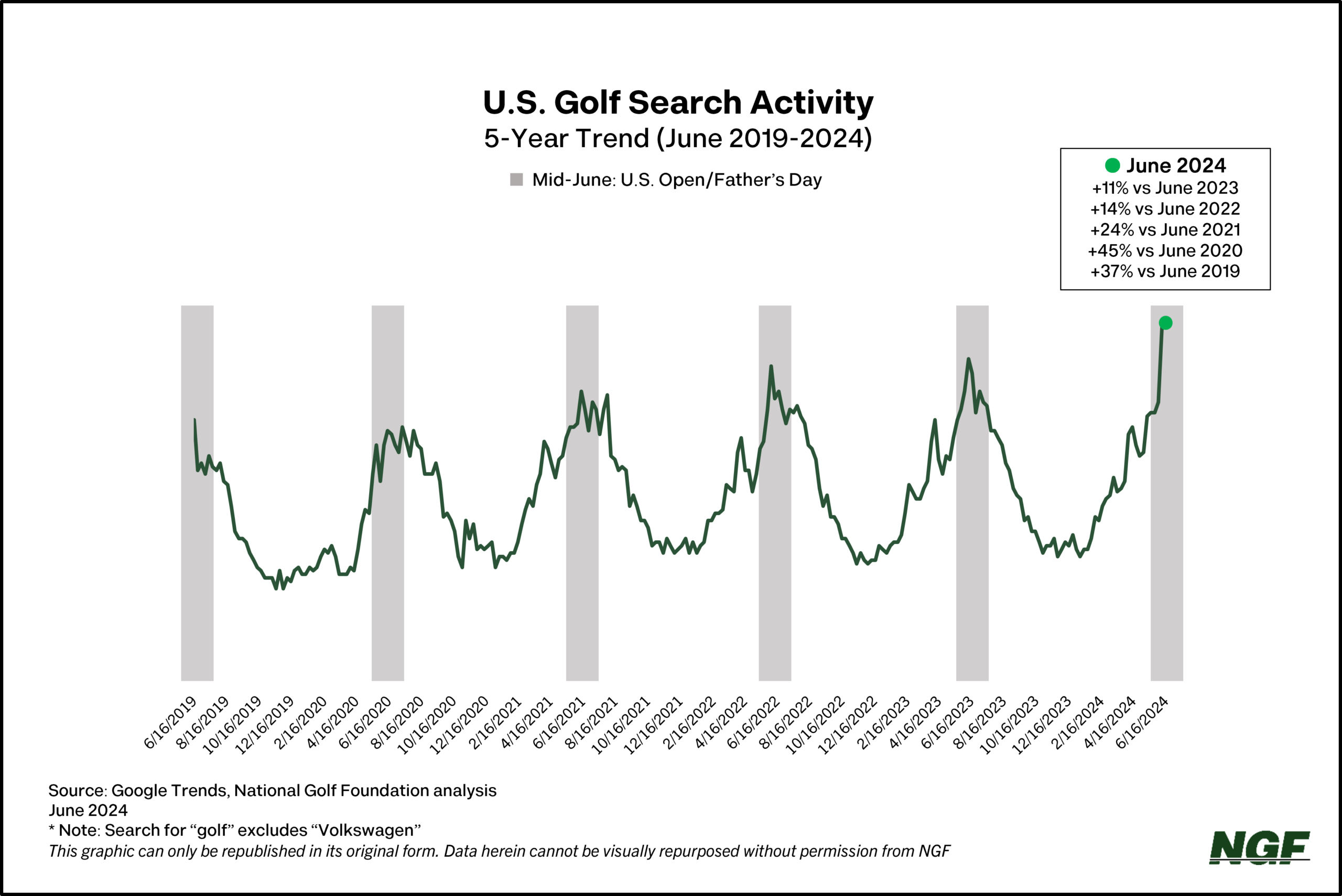

The window for new purchases – typically four to six years depending on the type of club – might be re-opening soon for many golfers, and interest in golf overall remains exceptionally high as evidenced by recent search data.

On the retail supply front, there’s been a moderate increase over the past few years in the number of brick-and-mortar doors, with companies like PGA TOUR Superstore and PXG continuing to open new physical locations. And then there’s the proliferation in the number of online businesses, from endemics to Amazon, that sell golf equipment, apparel and accessories to millions of golfers.

NGF members can find more research and trends regarding off-course retail supply here.

Meanwhile, retailers indicate that new golf technology, such as rangefinders and other distance-measuring devices, continues to be one of the strongest categories in the space. This demand is a by-product of increased engagement and lends support to the sustainability of golf’s consumer spend on playing fees and gear.

# For over 50 years golf equipment manufacturers have reported their monthly sales to NGF in units and dollars. Sales figures are aggregated and reported back to participating manufacturers.